Financial Planning

Mandatory Roth Catch-Up Contributions Begin in 2026

learn more

Taking RMDs Can Be Tricky. Here’s the Right Way.

learn more

Retirement Plan Considerations at Different Stages of Life

learn more

Key IRA Rollover Mistakes You Must Avoid

learn more

5 Useful Retirement Withdrawal Tips to Make Your Money Last Longer

learn more

Roth IRA Vs Traditional IRA How Much Will You Withdraw For Retirement?

learn more

Retirement Account Rollovers

learn more

Life Insurance in Retirement

learn more

Beneficiary Designations for Roth IRAs

learn more

Delayed Retirement Considerations

learn more

What to Know About Inheriting Retirement Savings Accounts

learn more

Estate Tax Changes Under Recent Tax Acts

learn more

QLACs: Your Retirement Accounts Can Act Like Pensions

learn more

How much money can I put into my IRA or employer-sponsored retirement plan?

learn more

Income in Respect of a Decedent

learn more

SECURE 2.0 Aims to Brighten the Future for Retirement Savers

learn more

Lump Sum Vs. Monthly Pension: What’s Better For Your Retirement?

learn more

What are catch-up contributions?

learn more

Planning for the Future with an ABLE Account

learn more

What Is Personal Finance, and Why Is It Important?

learn more

How to Manage Inherited IRA Rules That Can Surprise and Trap Heirs

learn more

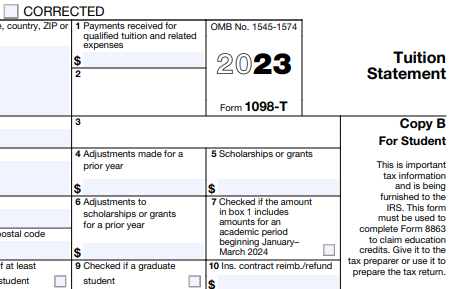

Key Retirement and Tax Numbers for 2025

learn more

3 Tax-Planning Numbers All Employees Should Know In 2025

learn more

8 ways to give your grandkids money without sacrificing your retirement savings

learn more

Exploring the Benefits and Tax Considerations of IRAs

learn more

8 Top Tax-Loss Harvesting Tips to Reduce Your Tax Bill

learn more

Can You Access Your 401(k) Money While You're Still Working?

learn more

Year-End Tax Planning Basics

learn more

I forgot to contribute to my IRA last year. Is it too late?

learn more

2024 Year-End Tax Tips

learn more

Retirement Saving: 2025 IRS Limits On Qualified Plans Affect Nonqualified Plans

learn more

Can I contribute to a Roth IRA?

learn more

4 Basic Facts to Know About IRAs

learn more

Thinking about taking money out? In-Service Withdrawals from 401(k) Plans

learn more

Don't Make This Retirement Savings Mistake. It Pays to Be Consistent.

learn more

How To Benefit From Your Benefits

learn more

Thinking of Selling Your Home? Don't Be Surprised by Capital Gains Taxes

learn more

6 New Retirement Rules And Tax Changes Everyone Should Know

learn more

The Retirement Drawdown Rule

learn more

Your 529 College-Savings Plan Can Now Fund a Roth IRA

learn more

How To Navigate Grief And Your Finances After The Death Of A Spouse

learn more

Understanding 401(k) hardship withdrawal: Rules and consequences

learn more

6 Expensive Mistakes To Avoid With Your 401(k) Rollover

learn more

Is Your 401(k) Contribution Strategy Costing You Money?

learn more

Required Distributions: Changes You Need to Know

learn more

Should I use my 401(k) to fund my child's college education?

learn more

What Should You Do With Your 401(k) When You Retire?

learn more

How To Invest For Your Children If They Don’t Go To College

learn more

Do Retirement Accounts Go Through Probate?

learn more

When Can I Retire? Key Factors, Strategies, and Expert Insights for 2024

learn more

What Is a Trust Fund and How Does It Work?

learn more

The Potential Benefits of Roth IRAs for Kids

learn more

My Spouse Is About to Receive a Pension

learn more

Can I still have a traditional IRA if I contribute to my 401(k) plan at work?

learn more

Can I Roll a Retirement Plan Distribution into an IRA?

learn more

Should I contribute to my 401(k) plan at work?

learn more

Charitable Contributions from IRAs

learn more

Smartphones, Email, Other Digital Assets And Your Estate Plan

learn more

New HSA Contribution Limits For 2025 Announced

learn more

What to Know About Inheriting Retirement Savings Accounts

learn more

Relief for Certain RMDs from Inherited Retirement Accounts for 2024

learn more

Demystifying Medicare for Retirement

learn more

The Corporate Transparency Act: A Comprehensive Guide

learn more

Understanding Bond Yields and the Yield Curve

learn more

Lump Sum vs. Dollar-Cost Averaging: Which Is Better?

learn more

Mutual Fund Basics

learn more

Understanding Mutual Fund Share Classes

learn more

Investing in Gold and Other Precious Metals

learn more

What is a Hedge Fund?

learn more

Investing: An Introduction

learn more

Exchange-Traded Fund (ETF): How to Invest and What It Is

learn more

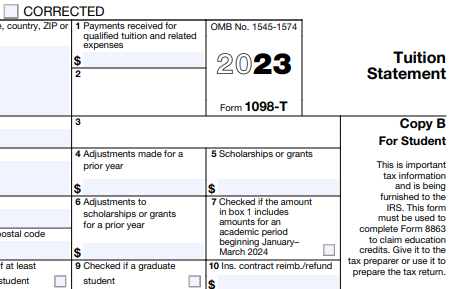

Your Guide to Taxes for Investors

learn more

Passive vs. Active Investing: A Comprehensive Guide

learn more

What is Leverage in Investing?

learn more

What Are The Magnificent Seven Stocks?

learn more

U.S. Savings Bonds for Education Savings

learn more

Yield to Maturity (YTM): What It Is and How It Works

learn more

If You Have a CD, Pay Attention to Your Rollover Date—and Avoid This Key Mistake

learn more

ESG Debt: Scoping Out the Universe of Sustainable Bonds

learn more

What is a Stock Index?

learn more

What Is a Mutual Fund?

learn more

Want To Own A Piece Of A Picasso? Democratizing Alternatives

learn more

Does Cryptocurrency Fit in Your Portfolio?

learn more

Back to Basics: Diversification and Asset Allocation

learn more

Enviromental, Social and Governance: Aligning Investment Choices with Social Causes

learn more

FAFSA for 2026-2027 School Year Opens on October 1

learn more

A Guide to Student Loan Repayment

learn more

The Pros and Cons of Four Alternatives to ‘529’ Plans for College

learn more

529 Savings Plans vs. Prepaid Tuition Plans

learn more

Versatile 529 Plans Can Help with More than Just College

learn more

529 Lesson Plan: High Scores for 529 Plans

learn more

How will my 529 plan be treated for financial aid purposes?

learn more

What is the college inflation rate?

learn more

Should I save for college in my name or my child's name?

learn more

What types of grants are available for college?

learn more

ABCs of Financial Aid

learn more

What are the major federal financial aid loan programs?

learn more

Can I open a 529 plan account with a lump sum?

learn more

Can I invest in any state's 529 plan, or am I limited to my own state's plan?

learn more

Your 529 College-Savings Plan Can Now Fund a Roth IRA

learn more

U.S. Savings Bonds for Education Savings

learn more

Should I use my 401(k) to fund my child's college education?

learn more

How To Invest For Your Children If They Don’t Go To College

learn more

I'm putting money into a 529 plan for my grandchild. But are the 529 assets subject to Medicaid spend-down requirements?

learn more

Can an UTMA/UGMA account reduce my child's financial aid for college?

learn more

What Is a 529 Plan?

learn more

What's the difference between a 529 savings plan and prepaid tuition plan?

learn more

Who can be a beneficiary of a 529 plan?

learn more

May 29 is 529 College Savings Day, and some states are giving kids a chance to win money

learn more

Withdrawing 529 Money Safely – A few key points to avoid penalties and taxes.

learn more

The Overlooked Estate Planning Step for Social Security Benefits

learn more

Social Security Disability Benefits

learn more

A Tale Of Two Retirees: New Senior Tax Deduction And Foreigners’ Social Security

learn more

How To Strengthen Your Retirement Plan Amid Social Security Concerns

learn more

New Social Security Identity Verification Rule: Are You Affected?

learn more

The Social Security Fairness Act Increases Benefits for Millions

learn more

How To Find Out How Much You Will Get From Social Security

learn more

Social Security: What Should You Do at Age 62?

learn more

Social Security: Can You Change Your Mind? Yes, But...

learn more

3 Ways To Prepare for Retirement While Facing a Social Security Shortfall

learn more

Will Remarrying Affect My Social Security Benefits?

learn more

Maximum Social Security Benefit: How Is It Figured?

learn more

How to Boost Your Social Security Check by 24%

learn more

Social Security 101

learn more

Social Security Retirement Benefit Basics

learn more

Understanding Social Security

learn more

Withdrawing 529 Money Safely – A few key points to avoid penalties and taxes.

learn more

Cost-of-Living Adjustments for SSI and Social Security

learn more

Medicaid and Nursing Home Care

learn more

What is variable life insurance?

learn more

Buying Supplemental Health Insurance: Medigap

learn more

The Importance of Reviewing and Updating Your Life Insurance Coverage as Your Family Grows

learn more

Five Questions about Long-Term Care

learn more

How to inventory your property for insurance claims

learn more

Charitable Gifts of Life Insurance

learn more

Medicare Prescription Drug Coverage

learn more

Medicare Costs Are Going Up in 2025—Here's the Impact on Your Wallet

learn more

Medicare Is Changing in 2025. How to Prepare.

learn more

Medicare Open Enrollment Is Full Of Surprises And Traps For Members

learn more

A Critical Combo: Life Insurance with Long-Term Care Benefits

learn more

Does Medicare Cover Home Health Care In 2024?

learn more

9 Major Medicare Changes for 2025 and How They'll Impact Your Coverage

learn more

New HSA Contribution Limits For 2025 Announced

learn more

How to Collect a Life Insurance Payout

learn more

Tax Tips: Long-Term Care Insurance

learn more

Making Decisions About Medicare

learn more

Should You Buy Long-Term Care Insurance?

learn more

Health Savings Accounts: Are They Just What the Doctor Ordered?

learn more

High-Income Individuals Face New Medicare-Related Taxes

learn more

Health-Care Reform: Credits and Subsidies

learn more

Irrevocable Life Insurance Trust (ILIT)

learn more

Withdrawing 529 Money Safely – A few key points to avoid penalties and taxes.

learn more

Designing a Benefit Package for Your Small Business

learn more

Benefit Plans for Small Businesses

learn more

What Payment Apps Report to the IRS? A Comprehensive Guide for 2025

learn more

Selling to Another Corporation

learn more

What are the beneficial ownership reporting requirements under the Corporate Transparency Act?

learn more

Two Tax-Friendly Retirement Plans for the Self-Employed

learn more

Can I change my business from a C corporation to an S corporation?

learn more

SWOT Analysis: How To With Table and Example

learn more

What kind of insurance coverage do I need for my small business?

learn more

Simplified Employee Pension Plans (SEPs)

learn more

401(k) Plans for Small Businesses

learn more

Understanding Individual 401(k) Plans

learn more

403(b) Plans

learn more

Business Succession Planning

learn more

Record Keeping for Your Own Business

learn more

Your First Look At 2025 Tax Rates: Projected Brackets, Standard Deductions And More

learn more

Understanding Your Credit Report

learn more

2024 Tax Facts At-a-Glance

learn more

End of Year Checklist

learn more

Cost-of-Living Adjustments for SSI and Social Security

learn more